Five Ways Franchises Can Find More Skilled Job Applicants

Skills Assessments

What way to get better-skilled applicants than to see what skills they have early in the hiring process? Skills assessments are used to narrow your candidate pool down to those truly suited for the position. Skills assessments allow employers to make data-driven decisions and provide a clear picture of employees’ skills and expertise.

Incorporate Asynchronous Video Interviews

The average job posting gets 250 applications, but only 2-3% of those actually interview, mainly due to scheduling and time constraints. Using asynchronous video interviews as the first step of the interview process dramatically expands the number of candidates you can initially hear from, broadening the chance that you don’t miss out on the skilled applicants who’ve applied to your open positions.

Applicant Pooling

Applicant pooling is a franchise recruiting software feature that allows you to share applicants across different job postings and locations within your account. This is an excellent tactic for multi-location businesses. If a skilled job applicant you could use at one location applies to another, you won’t miss out on that potential new employee with applicant pooling!

Post QR Codes in Your Locations

Who better to become your next enthusiastic team member than a current customer? You probably have many skilled potential employees coming in and out of your franchise location and don’t realize it. Advertise your open positions and include a QR code in your lobby or menus. 60% of job seekers quit an application process because it has too many barriers. A QR code in a place a job seeker already frequents is about as barrier-free as the application process gets.

Strengthen Your Employer Brand

Employer branding is the perception of what it’s like to work at your company. Examples of employer branding could be anything from employer-produced collateral, social media postings, or employee success stories and reviews on sites like Glassdoor. Skilled employees have their picks of open roles these days and can afford to be picky. Today’s top job candidates also do their homework and will research what it’s like to work at your organization.

We recommend creating employee testimonials, either written or on video, which you can post to your job descriptions, career page, and social media channels. This is a great way for potential skilled employees to hear why your organization is a great place to work, straight from their potential future coworkers!

An Applicant Tracking System Can Help

An applicant tracking system (ATS) is recruiting software built to automate and streamline hiring. A private label applicant traffic system designed for franchises allows you to brand your solution, customize your workflows, or integrate them into your existing systems. A private label applicant tracking system also lets you templatize key recruitment components such as job descriptions and offer letters to ensure consistency across your organization.

Competitive applicant tracking systems will include all of the features and capabilities listed above, and 78% of ATS users report that ATS use has improved the quality of their hires!

Read More

Despite Interest Rate Rise, Loans Among Top Sources Expected for Funding Business Startups

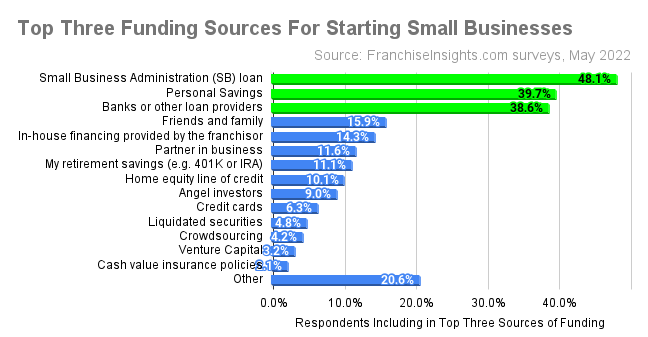

June 22, 2022 — Most aspiring franchise buyers plan to take advantage of Small Business Administration loans and bank loans, at 48.9% and 45% respectively, despite the rapid rise in interest rates seen in the last few months. Another 14.3% are hoping to take advantage of in-house financing by the franchise they are purchasing.

These results are according to surveys conducted by FranchiseInsights.com in May, where “personal savings” was second most often cited, at 39.7% of respondents. “Friends and family” was indicated by 14.3%, and the second most popular non-loan source.

The total percentages add up to more than 100% since respondents were instructed to choose their top three sources.

The “other” option was chosen by over 20% of respondents. The top “other” sources cited were as varied as “business grant”, “sale of home” and “sale of business” among many more.

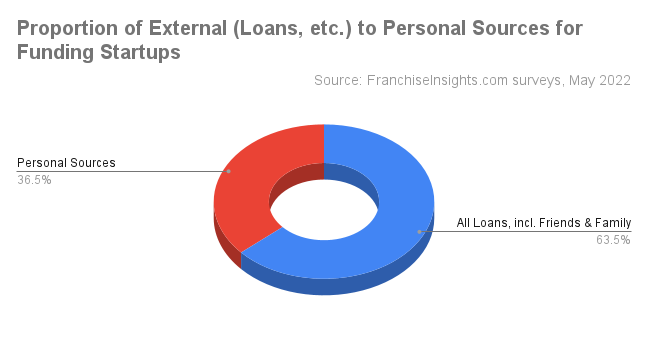

By aggregating sources into two buckets, we see that entrepreneurs are assuming that over one third (36.5%) of startup capital sources will be from their own personal resources. The remaining 66.2% of sources will come from outside their balance sheets. “Other” sources were excluded from this view.

Personal Sources – for this analysis include personal savings, retirement funds (401K or IRA), credit cards, cash value insurance policies, and liquidation of securities. Though home equity lines of credit are technically a loan secured by the home, it was included for this analysis since it represents buyer equity.

Outside Sources – include Small Business Association (SBA) loans, banks or other loan providers, franchisor financing, venture capital, angel investors, and friends and family.

The “personal sources” share at 36.5% was only slightly higher than the 33.8% seen in our analysis of startup funding sources back in March.

Leverage to make a larger purchase and the tax deductibility of business interest go a long way to explain the popularity of debt as a key source of startup capital. Undoubtedly the reliance on debt sources for startup capital is aided by historically low interest rates in the United States, and the existence of lending programs facilitated by the Small Business Administration.

It will be interesting to see how this changes in future surveys as the Federal Reserve begins tightening through interest rates this week and reduction in its balance sheet holdings of government debt over time.

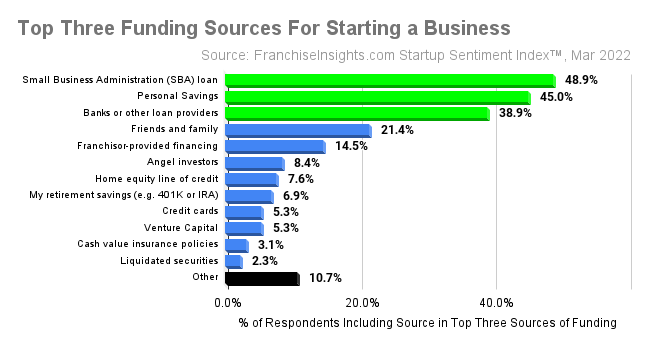

SBA Loans and Personal Savings Are Top Two Sources Expected for Funding Business Startups

March 16, 2022 — Most aspiring franchise buyers plan to use Small Business Administration loans and personal savings to start their businesses, at 48.9% and 45% respectively, according to the FranchiseInsights.com Small Business Startup Sentiment survey. Loans from banks or other lending institutions were identified as the third most common source at 39.8%. The percentages add up to more than 100% since respondents were instructed to choose their top three sources.

The “other” option was chosen by about 11% of respondents. The top “other” sources cited were “funds from a business partner” and “crowdfunding”, which will be choices added to future surveys.

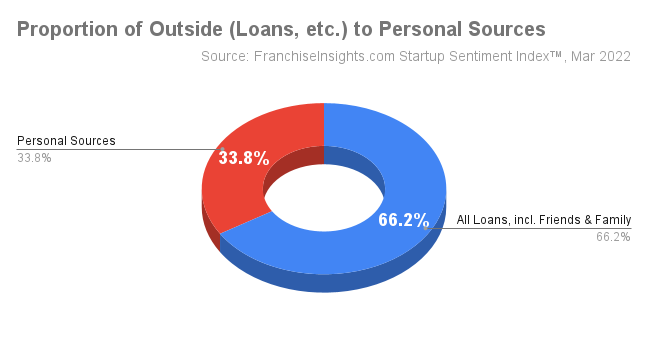

By aggregating sources into two buckets, we see that entrepreneurs are assuming that about one third (33.8%) of startup capital sources will be personal. The remaining 66.2% of sources will come from outside their balance sheets. “Other” sources were excluded from this view.

Personal Sources – for this analysis include personal savings, retirement funds (401K or IRA), credit cards, cash value insurance policies, and liquidation of securities. Though home equity lines of credit are technically a loan secured by the home, it was included for this analysis since it represents buyer equity.

Outside Sources – include Small Business Association (SBA) loans, banks or other loan providers, franchisor financing, venture capital, angel investors, and friends and family.

Undoubtedly the reliance on debt sources for startup capital is related to the decades-low interest rates experienced in the last few years in the United States. It will be interesting to see how this changes in future surveys as the Federal Reserve begins tightening through interest rates this week and reduction in its balance sheet holdings of government debt over time.

FranchiseInsights.com compiles monthly the Small Business Startup Sentiment Index™ (SSI) of individuals who have recently inquired about businesses for sale.The most recent Startup Sentiment Index™ survey was conducted February 24-28, 2022.

Download a copy of the February 2022 FranchiseInsights.com SSI report here. See excerpts from prior SSI™ surveys and subscribe to receive the Small Business Startup Sentiment Index™ monthly report when it is released.

The Small Business Startup Sentiment Index™ is based on a monthly survey of individuals who have recently inquired about businesses or franchises for sale on the digital assets of FranchiseVentures.

FranchiseVentures is the leading demand– and lead-generation platform for potential franchisees to thousands of growing franchise systems in the United States and Canada. Its franchise lead generation brands include Franchise.com, Franchise Solutions, Franchise Gator, Franchise Opportunities, Franchise For Sale, SmallBusinessStartup.com and BusinessBroker.net, and together they provide the largest aggregation of prospective franchise buyers in the U.S.

IFA Recognizes Benetrends for Helping Prospective Franchise Owners Secure Funding

Benetrends has been named the preferred vendor for IRA/401(k) rollover financing solutions by the International Franchise Association (IFA). Both parties understand how securing business funding can change lives. “IFA is pleased to announce this new partnership with Benetrends, who have shown their longtime support for the association and franchising as a whole,” said Matthew Haller, President and CEO of IFA. “Funding solutions are one of the most critical aspects of starting a business, and since it first introduces Rollover-as-Business Startup funding, Benetrends has been a leader in helping aspiring entrepreneurs find an affordable way to achieve their dreams.”

Benetrends and Franchising

Founded by Len Fischer (top photo), Benetrends was started to help entrepreneurs secure funding to start a business. Benetrends is the oldest and largest funding provider in the franchise space and is the original company that created the option to use retirement funds for a business without tax or penalty. The company is known as the architect of 401(k)/IRA retirement funding for the franchising industry.

Benetrends‘ Rainmaker Plan allows for funding with a 401(k)/IRA loan, or a Rollover-as-Business-Startup, without loan payments or interest. This enables potential business owners to use retirement funds for a new business. Benefits of the Rainmaker Plan include improved cash flow and equity. It lets new business owners pay themselves a salary from the start of the business and secure funding in two to three weeks or less.

Rocco Fiorentino, CFE, Benetrends Vice Chairman of the Board, says that the company’s dedication to excellence has kept it going for so long. “Franchising provides entrepreneurial opportunities to so many individuals who would not have them otherwise,” Fiorentino said. “We are proud of the product we have been able to provide at Benetrends for over 40 years, giving a means for more than 17,000 entrepreneurs to achieve their dreams of business ownership and create jobs and prosperity.”

The Basics of a Business Purchase Agreement

Written by Live Oak Bank

During the sale of a business, both the seller and buyer must follow a certain legal process. After signing a letter of intent and completing due diligence, a business purchase agreement marks the official start to the legally binding transaction of a business. This agreement requires the buyer to purchase the business according to the terms and price outlined in the agreement. These documents can be lengthy and full of legalese, which is why an experienced attorney should create the purchase agreement.

Purchase agreements are complex but typically have several standard sections. The biggest takeaway on purchase agreements is this: while it’s ideal to let an attorney handle the terms and conditions it’s not a bad idea to have a general understanding of each section, as we’ve outlined below. Both parties should understand what they’re signing, so leverage your professional team to help you translate some of the legal jargon and technical language.

Parties

This section appears at the beginning of the purchase agreement and lists the legal names of the seller and buyer, as well as their contact information.

Description of Business

All aspects of the business are outlined here, including the location and purpose of the business, the services and products of the business, the business entity, management systems and structure, financial summary and overview of target customers. This section also includes a statement verifying the seller’s legal right to authorize the sale as well as additional legal representations and warranties.

Sale

It’s critical to define the type of sale, along with assets included and excluded from the sale in this section. Potential assets included could be equipment/machinery, fixtures, inventory, accounts recoverable and lists of customers and goodwill. Potential assets excluded could be cash, company vehicles, real estate and more. This section of the business purchase agreement will also have the transfer of property, with the seller’s “Agreement to Sell” and the buyer’s “Agreement to Buy.”

Covenants

This section of the business purchase agreement outlines the provisions that the seller is responsible for covering before and after the closing, such as tax liabilities, loan obligations, third-party fees, transferring employee benefit plans and employee salaries. This is also where buyer and seller agreements can be listed, including protective clauses like non-compete, confidentiality, intellectual property, non-solicit and indemnification agreements.

Transition

After the transaction closes, both buyer and seller need a solid understanding of who’s responsible for what including the seller’s role in the business after the sale (if any), who’s on the hook for training new employees and who will be notifying customers that the sale has transpired.

Participation or Absence of Brokers

If third-party brokers were used in the transaction, this section of the business purchase agreement covers the legal names and contact info of those facilitators, as well as the party responsible for paying the broker.

Closing

This section of the business purchase agreement is usually straightforward, as it covers the logistics, date and time of closing. It also issues title transfers and outlines what money will be paid upon closing.

Appendices

Any number of additional documents can be attached to this section of the business purchase agreement including letter of intent, financial statements, valuations, buyer/seller resumes, marketing plans and vendor agreements.

While this summary of the fundamental sections of a purchase agreement covers the basics, it is not the complete list of the process. Both buyers and sellers should be aware of the full scope and the importance of having a solid team in place throughout the transaction cannot be overstated. An attorney, plus an accountant and a broker (if applicable) will be key players in not only understanding the purchase agreement but making any necessary negotiations.

Survey Analyzes Responses

The number of businesses being bought and sold continued to rebound, with closed transactions in the third quarter up 17% over the previous quarter, and 11% year-over-year, according to BizBuySell’s Insight Report, which tracks and analyzes U.S. business-for-sale transactions. The report also analyzes survey responses from roughly 2,400 business owners, buyers, and brokers.

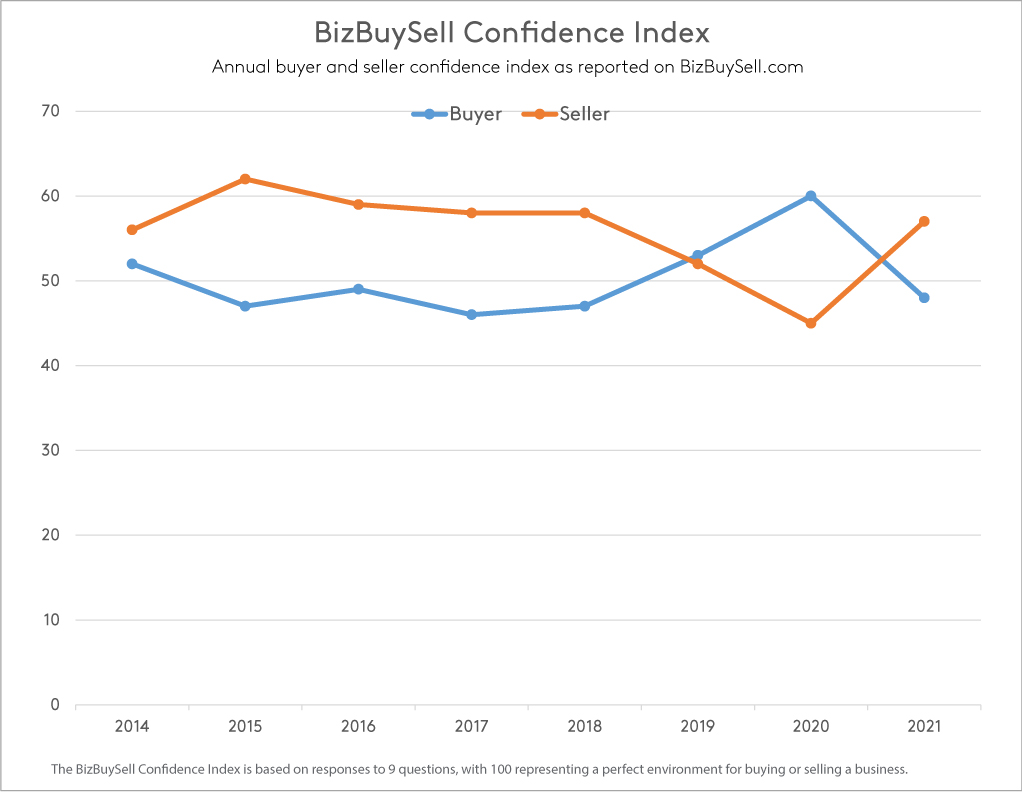

Sellers are returning to the market, feeling more confident they can receive a good price and less willing to wait as the pandemic lingers on. Seller confidence climbed to 57, up from 45 in 2020, which is the highest mark since 2018’s high of 58. Of those surveyed, 49% believe they could receive a higher sale price today compared to a year ago, with 46% saying the top factor being improved sales/revenue.

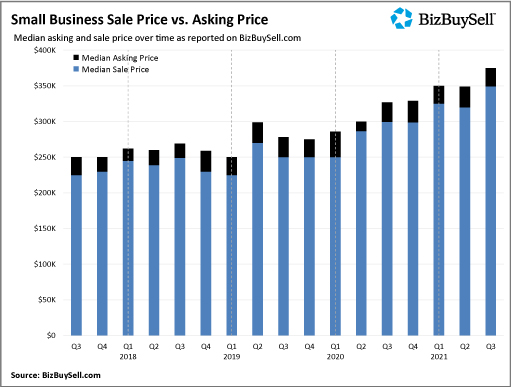

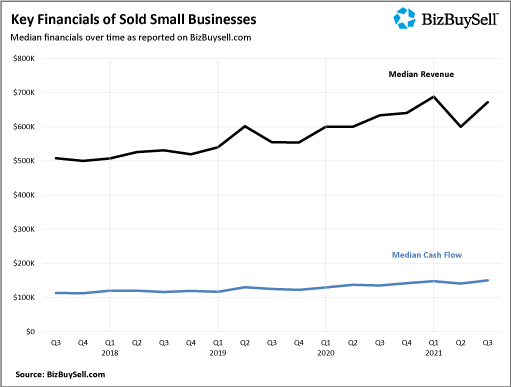

The median revenue of businesses sold in the third quarter was $671,713, up 6% year-over-year. Meanwhile, buyers are paying record-high prices for businesses that have continued to perform well during the pandemic. The median sale price in the third quarter hit a new high of $349,500, 17% above the previous year and 40% above 2019’s Q3 pre-pandemic levels.

With a limited supply of profitable businesses and regret over missing last year’s lower prices, buyer confidence fell to 48, significantly down from 60 in 2020 and slightly above the 47 scored in 2018.

Moreover, demand for high performing businesses is heating up. BizBuySell’s traffic has grown 29% since this same time in 2019. Yet, as many owners remain focused on recovery, supply is still limited – the perfect storm for a sellers’ market.

“There are still fewer sellers on the market than there otherwise would have been due to COVID and post-COVID challenges. However, we signed up more clients in Q3 than any other quarter and I feel strongly that burned out sellers are going to be coming out to market more robustly in 2022,” said Max Friar of Calder Capital, LLC.

Owners Face Ongoing Labor Shortages and Rising Costs as Consumer Spending Picks Up

With COVID infection rates dropping and students back in school, retail sales are picking up. According to the U.S. Census Bureau, retail spending in September increased 13.9% over the previous year. However, many businesses still struggle to attract or retain employees. In fact, 49% of owners say the labor shortage is impacting their business, while business brokers see it as the number one concern facing small businesses.

“We have done everything from raising wages, increasing benefits, and providing training. If things do not improve with the ability to hire and retain employees, I will be forced to sell my business,” said Michael DiNardo of Silvio’s Restaurant & Pizzeria in New York.

According to Charles Spickert, CBI of Touchstone Business Advisors, the labor shortages are at the foundation of other prominent issues facing small businesses. “Labor shortages seem to be affecting every sector, which in turn cause rising costs (of labor) and supply chain disruptions,” said Spickert.

Despite shipment delays and rising costs for material and labor, 47% of small business owners surveyed said their business is performing better than in 2020. Median revenue for businesses sold in the third quarter increased 12% over the previous quarter and 6% year-over-year.

Owners Combat Operational Challenges with Shift to Enhanced Digital Efficiencies

Since the pandemic began, 50% of surveyed small business owners have pivoted to a more digital environment, through serving customers virtually, online ordering, and delivery apps. As the pandemic and its impact shifts toward our rearview mirror, 76% of owners say they consider the digital changes they’ve made permanent.

“Many of today’s businesses are emerging with a stronger, more modern business model that’s attracting today’s buyer. My people tell me they never want to go back to paper. It has made us more efficient, profitable, and made our employees and customers happier.” according to M.G., a business owner in Washington.

Not only is this digital shift improving efficiencies and profitability, but it’s also making those businesses more valuable to potential acquirers. Sixty-four percent (64%) of buyers say it’s important for a business to have a strong online footprint in their buying decision, over half saying extremely important.

For some buyers, however, those businesses excelling without a digital presence could present an opportunity for easy upside. “If the business is already profitable without a website, I see this as a nice value-add opportunity following acquisition,” said a buyer named Ben in Alaska.

Today’s Buyers: Corporate Refugees and Serial Entrepreneurs Seeking Stability

Despite the pandemic’s economic upheaval, the U.S. Census Bureau reported a boom in entrepreneurial activity. A record number of applications to start new businesses were received in both 2020 and the first half of 2021. An increased interest in business ownership is also reflected in BizBuySell’s record high traffic now compared to before the pandemic.

As the pandemic reshaped the economy, including reshuffling how we work and spend money, it opened new opportunities for those seeking business ownership, including corporate refugees who have either lost their jobs or were forced into retirement.

Forty-four percent (44%) of surveyed business buyers identify as wanting to leave their current job to be more in control of their future, with an additional 13% being newly unemployed. As further support, surveyed business brokers named corporate refugees seeking financial freedom as the top ranked segment to describe today’s business buyers, followed by serial entrepreneurs.

“Most of the businesses that we sell are sold to individual buyers. Most of whom have worked for a larger company and are seeking to become entrepreneurs,” said Friar.

When it comes to making a purchase decision, the ideal opportunity for buyers presents both stability and value. If having to choose, 42% of brokers say buyers are focused on stability versus 13% saying value.

“In my experience, buyers of businesses on Main Street or the lower middle market prefer stable companies. If a company is declining, they do not want to ‘catch a falling knife’ and if a company is surging, they are often deterred by the seller’s increasing valuation expectations as well as concern that exponential growth may be short-lived and unsustainable,” said Friar.

This underlines buyers’ concerns over purchasing businesses that have not performed well during the pandemic. Desire for stability also explains why the resilient service sector is so popular in today’s market. In addition to making up 42% of second quarter transactions, 1 out of 3 surveyed buyers indicated a desire to purchase a business in the service sector.

“Businesses that provide ‘essential’ services are more likely to withstand economic downturns and pandemics. Consequently, they are more attractive to buyers than most other types of businesses,” said Tony Torella of Excelsior Business Group, LLC.

Small Business Market Outlook

Despite economic ups and downs brought on by the ongoing pandemic, the business for sale market continues to rebound. As more businesses recover their losses and show improved financials, more sellers are expected to return to the market.

In fact, twenty-eight percent (28%) of owners surveyed said they plan to sell in the coming year, either due to retirement (52%) or burnout (38%). Plus, 41% of these owners identify as Baby Boomers.

With businesses selling at record-high prices, owners of strong performing businesses could see today’s market as an opportunity to exit at a high point. This is especially true for those burnt out by pandemic related challenges or seeing a window open for retirement.

“Between last year’s shutdowns, this year’s mandate issues, the difficulty in finding and keeping employees, and now higher taxes looming, many are choosing to sell. First time buyers are stepping up to buy a job, relocate from a less favorable environment, and to create an improved lifestyle for themselves and their families,” said Sheila Spangler of Murphy Business Sales – Mountain West.

For any owner considering taking advantage of these conditions, Jason Ward of TruView Business Advisors offers the following advice, “We are starting to see an uptick in sellers ready to take their business to the market. We are advising our clients who are considering selling in 2022 to start the process as soon as possible to get in before the market is saturated with inventory.”

With more sellers expected to enter the market, buyers can expect to find a healthier supply of strong performing businesses. Moreover, buyers can and still take advantage of relatively affordable financing. These conditions should present opportunity for entrepreneurs on both sides looking to make a change.

Q3 2021 Small Business Values

The $349,500 median sale prices continue a trend of new highs, up 9% from last quarter. Restaurant prices maintained the healthy gains achieved in the second quarter, while service and retail business prices accelerated 20% and 7% respectively. With many businesses having recovered from peak pandemic losses, today’s market presents an opportune time for owners to exit. That being said, it’s also presented a challenging dynamic for business valuations, where the last 18 months resemble a roller coaster on the income statement.

Fifty-two (52%) of brokers surveyed recommend using a blend of pre-pandemic and current financials to value businesses depressed by the pandemic yet since recovered. Twenty-six (26%) say to use current (recovered) financials, with 13% recommending pre-pandemic financials.

“I think it is fair to ‘throw out’ 2020 so long as the reasons for weaker financials are tied directly to having to close the business and presently the business is running smoothly again. Now, this doesn’t mean buyers are going to universally accept this analysis,” said Friar.

Q3 2021 Small Business Financial Health

After experiencing a dip last quarter, the median revenue and cash flow of sold businesses increased 12% and 7% respectively versus the prior quarter and up 6% and 11% compared to a year ago. Digging deeper however, it’s clear that increasing costs associated with supplies and labor are still having a very meaningful impact.

Looking at cash flow by sector specifically, positive quarter over quarter gains reflect strong 15% growth in the service sector offsetting declines in every other industry. Based on this, it’s no surprise service businesses were selected as the most popular acquisition in today’s market by surveyed brokers.

“Service businesses are not as affected by import logistics related problems, are scalable, have a low asset base, and generally have no customer concentration issues,” said Robert Flynn of United Brokers Group LLC.

Manufacturing companies saw the largest quarter-over-quarter median cash flow decline, down 11%, followed by retail (9%) and restaurants (4%). In fact, the median cash flow of sold manufacturing businesses is now down 26% compared to businesses sold in the 1st quarter, with retail down 14%. As result, associated median sale prices have declined 27% and 5% over the same period, respectively, these two sectors being the most heavily impacted by supply chain disruptions.

George Rosen of Contango Investments, Inc. explains, “Manufacturing and construction jobs are getting pushed back due to supply constraints. Revenue is getting pushed back two to six months.” Friar adds, “When businesses can’t get parts or components, they can’t complete or ship products. So lead times are ridiculously long not only in manufacturing but also in construction, home furnishings, you name it.”

Q3 2021 by Deal Size

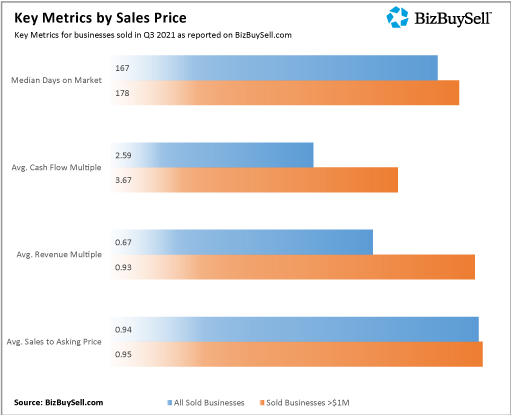

Nineteen percent of transactions sold for a price of $1 million or higher during Q3 2021, the same number as the prior quarter. These businesses had a median cash flow of $500,000 and were on the market for 178 days, compared to $150,251 and 167 respectively for all businesses. The 178 median days on market is a slight increase from 168 days in Q2, breaking a streak of 3 consecutive quarters with shorter sale time frames for these higher value businesses.

In addition, businesses selling for $1 million or higher averaged a .93 revenue multiple and 3.67 cash flow multiple, in line with last quarter and significantly higher than the .67 and 2.59 multiples, respectively, for all businesses. Lastly, most of these larger acquisitions occurred in the service industry (43%), followed by retail (16%), manufacturing (12%) and restaurant (4%) sectors. The sector breakdown follows the same trend seen last quarter.

Read More

The Importance of Owner Flexibility

You shouldn’t expect to sell your company overnight. For every company that sells quickly, there are a hundred that take many months or even years to sell. Having the correct mindset and understanding of what you must do ahead of time to prepare for the sale of your company will help you avoid a range of headaches and dramatically increase your overall chances of success.

First, and arguably most importantly, you must have the right frame of mind. Flexibility is a key attribute for any business owner looking to sell his or her business. There are many variables involved in selling a business, and that means much can go wrong. An inflexible owner can even irritate prospective buyers and inadvertently sabotage what could have otherwise been a workable deal.

Be Flexible on Price

A key part of being flexible is to be ready and willing to accept a lower price. There are many reasons why business owners may fail to achieve the price they want for their business. These factors range from lack of management depth and lack of geographical distribution to an overreliance on a handful of customers or key clients. Of course, one way to address this problem is to work with a business broker or M&A advisor in advance, so that such price issues are minimized or eliminated altogether.

Be Prepared to Compromise

In the process of selling your business, you may want to achieve confidentiality and sell your business quickly and for the price you want. However, the fact is that most sellers find that it is possible to have confidentiality, speed, and the price you want, but not all three. Ultimately, you’ll have to pick two of the three variables that are most important to you.

Be Patient

A third way in which business owner flexibility can boost the chances of success is to embrace the virtue of patience. By accepting the fact that businesses can “sit on the shelf” for a considerable period of time, you are shifting your expectations. This realization can help reduce your stress level. The fact is that stressed out owners are far more likely to make mistakes.

Sometimes Losing is Really Winning

A fourth way in which business owners should be flexible is realizing that you and your lawyer will not win every single fight. There will be many points of contention, and a smart dealmaker realizes that it is often better to have a good deal than a perfect deal. You may have to make sacrifices in order to sell your company. Simply stated, you shouldn’t expect the other side to lose every point.

At the end of the day, a savvy business owner is one that never loses sight of the final goal. Your goal is to sell your business. Seeing the situation from the buyer’s perspective will help you make better decisions on how you present your business and interact with prospective buyers. Maintaining a flexible attitude with prospective buyers helps to position you as a reasonable person who wants to make a deal. Goodwill can go a long way when obstacles do arise.

Copyright: Business Brokerage Press, Inc.

The post The Importance of Owner Flexibility appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

The Main Street Lending Program

There is no doubt that the COVID-19 situation seems to change with each and every day. The disruption and chaos that the pandemic has injected into both daily life and business is obvious. Just as it is often difficult to keep track of the ebbs and flows of the pandemic, the same can be stated for keeping up to speed on the government’s response and what options exist to assist companies of all sizes.

In this article, we’ll turn our attention to an overlooked area of the government’s pandemic response and how businesses can use a whole new lending platform to navigate the choppy waters.

As the pandemic continues, you will want to be aware of the main street lending program, which is a whole new lending platform. It was designed for businesses that were financially sound prior to the pandemic. Authorized under the CARE Act, the main street lending program is quite attractive for an array of reasons. Let’s take a closer look at what makes this program almost too good to be true.

This lender delivered program is a commercial loan. Unlike the PPP, there is no forgivable component. However, the main street lending program does have one remarkable feature that will certainly grab the attention of all kinds of businesses. It can be used to refinance existing debt at a rate of around 3%. With that stated, it is also important to note that businesses cannot refinance existing debt with the current lender. Instead, a new lender must be found. Generally, loans are a minimum of a quarter million dollars and have a five-year term. In another piece of good news, there is a two-year payment deferment period.

The main street lending program can be used in a variety of ways. In short, the program is not simply for refinancing existing debt. Additionally, there is no penalty for prepayment. The way the program works is that lenders make the loans and then sell 95% of the loan value to the Fed. This of course means that the lender is only required to retain 5% of the loan on their balance sheet. The end result is that lenders can dramatically expand the amount of loans they can make.

Whether it is the PPP or a program like the main street lending program, there are solid options available to help you. Businesses looking to restructure debt or put an infusion of cash to good use may find that the main street lending program offers a very flexible loan with great interest rates.

Copyright: Business Brokerage Press, Inc.

The post The Main Street Lending Program appeared first on Deal Studio – Automate, accelerate and elevate your deal making.

Why Does Your Business Need Google Reviews?

In today’s business climate, reviews are the differentiator. Years ago, people commonly asked for references when they were vetting a product or service. But these days when people are searching for a local business to work with, they are likely to conduct research on their own and read online reviews.

Google reviews can give businesses a big credibility boost without having to spend a dime. Let’s take a look at some of the key benefits.

Increased Credibility & Trust

According to statistics, approximately 91% of consumers read reviews to determine credibility of a local business. In fact, 84% of consumers say the positive reviews have helped them gain trust. Without the reviews, that level of trust would not have been established.

Needless to say, people trust Google. The fact that these reviews are on a 3rd party website increases transparency. These reviews have much higher value than testimonials posted on the actual business website.

Improved Business Conversions

Once a potential customer gains trust in your company through reading Google reviews, it is more likely the conversation will get converted to an actual business transaction.

Customer Feedback Loop

When your customers write reviews about your business and post them on Google, these reviews often clearly mention details about your product or service. Through this means, future customers become educated. These reviews can also serve as a feedback loop for you if things need improvement.

Increases Online Reputation & Visibility

The power of online marketing methods you might be using to promote your business will be amplified, as users will become more attracted to your business due to 5-star reviews. This factor increases online traffic to your website and an increase in leads and business.

Another fact to be conscious of is that your clients will review your products or services whether you want them to or not. If you fail to set up Google reviews, you’re missing out on the opportunity to gain a level of control and visibility.

How to Set Up Google Reviews

- Create a Google My Business account. – Visit https://business.google.com/ to sign in or create a Google account for a business. Complete the step by step process by filing required information like email, phone number, business details, etc.

- Ask clients to review your services. – Start sharing your Google My Business URL with clients and ask them to post a review about your services. When asking for reviews, you can mention to clients that their review will help everybody else make an informed decision when they are looking for help. It is important to ask about the review within a few days of closing your transaction. If more time goes by, the client may be less motivated to post a review for you.

- Remind clients. – Everybody is busy. Therefore, there is a chance that your client might forget to write a review. In this case, we recommend reminding them to do so. You can also politely inquire if they need any help posting the review that you discussed.

Through the above-mentioned process, you can begin generating reviews for your business. Of course, it goes without saying that you can only guarantee good reviews when you are providing excellent customer service along with a top-notch product or service.

Copyright: Business Brokerage Press, Inc.

The post Why Does Your Business Need Google Reviews? appeared first on Deal Studio – Automate, accelerate and elevate your deal making.